Loyalty is Strong, But Future Growth Hinges on Younger Customers

OCTOBER 2025 | Spark age segment analysis uncovers the risks of an aging customer base and the strategies to close the gap.

Mutual banks enjoy strong loyalty, particularly among older members, which has been a cornerstone of stability for the sector. At the same time, the customer base is steadily aging, and growth will increasingly depend on bringing younger Australians into the fold.

This presents an exciting opportunity: by complementing retention with fresh acquisition strategies, mutuals can replenish their base and build strong relationships with the next generation.

Insights

The overall customer base is aging — the average age has increased by almost three years over the past five years (from around 50.6 to 53.3).

New customers continue to be younger than the overall base, though their average age is also rising (from about 39.4 in 2021 to 44.4 in 2025).

As a result, the age gap between new and existing customers has narrowed — from an 11-year difference in 2021 to 9 years in 2025.

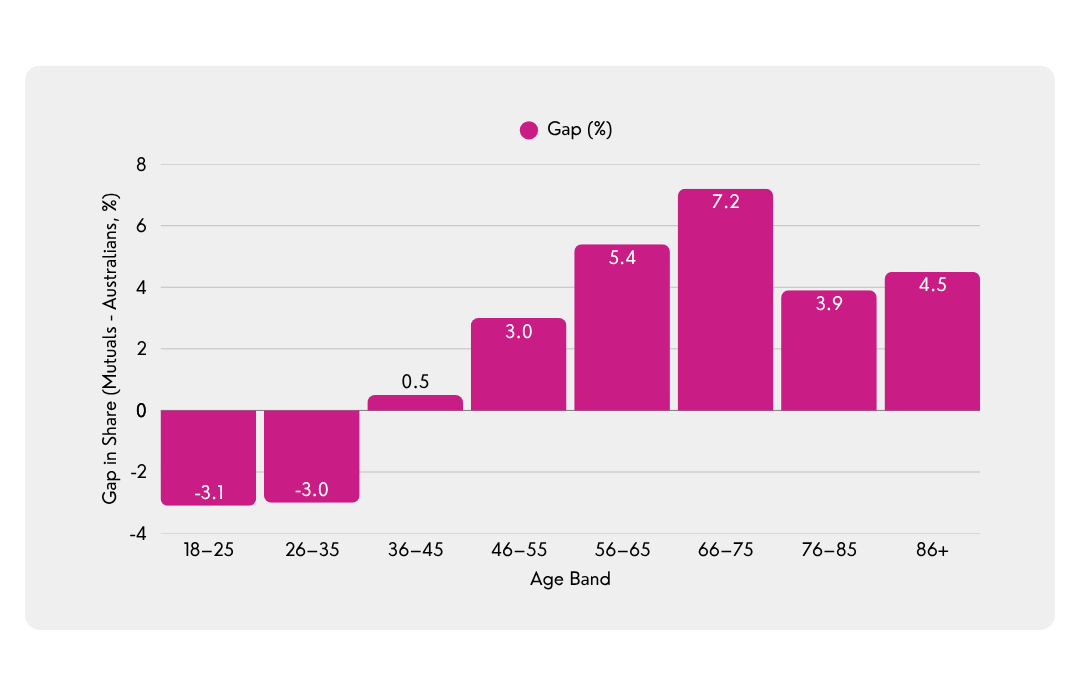

Customer Base Aging Faster than the Australian Population

When comparing the age profile of mutual bank customers with the broader Australian population, a clear pattern emerges. Mutuals hold deep strength among older cohorts, particularly retirees and pre-retirees, but are under-represented among younger adults. This imbalance highlights both the loyalty that has long underpinned mutual banking and the opportunity to broaden appeal to the next generation.

KEY FINDINGS

1. Under-representation in Younger Adults (18–35)

Australians: 23.2%

Mutual banks: 17.1%

Mutuals are attracting fewer younger customers relative to their population share, signalling a structural gap and softer appeal among students, early-career professionals, and first-home buyers – the very cohorts that drive long-term growth.

2. Over-representation in Mid-Career (36–55)

Australians: 25.5%

Mutual banks: 29.0%

Mutuals have their greatest strength among mid-career, family, and mortgage-holding customers. This aligns with their traditional product base – home loans, family banking, and personal service – and remains a relative stronghold compared to the national picture.

3. Strong Appeal to Pre-Retirees (56–65)

Australians: 12.6%

Mutual banks: 18.0%

Mutuals are significantly over-indexed in this segment, reflecting strong loyalty among pre-retirees who value stability, personal service, and community connection.

4. Heavy Skew to Seniors (66+)

Australians: 16.1%

Mutual banks: 31.7%

Retirees account for nearly twice the population share within mutual banks — a testament to their heritage and community connection, but also a clear aging risk if younger segments aren’t replenished.

Overall Implications

Strengths

Mutual banks continue to excel with older, higher-value customers — a group that delivers stable deposits, strong term-deposit performance, and enduring loyalty. This strength reflects deep community ties and a reputation built on trust, service, and personal relationships.

Risks

The average customer age now sits well above the national benchmark. With fewer 18–35-year-olds joining, the customer base is gradually aging — creating a structural risk to future growth, product relevance, and long-term sustainability.

Strategic Priority

The opportunity now lies in rebalancing the customer mix — maintaining the loyalty of established customers while building stronger appeal with younger ones. That means thinking differently about acquisition, engagement, and experience.

Younger customers respond to convenience, purpose, and personalisation. Mutual banks can reach them by:

Expanding digital acquisition channels — optimising onboarding journeys, integrating with payroll systems, and using data triggers to engage customers early.

Creating offers that meet life stages — first-home buyer packages, savings goals linked to lifestyle milestones, or early-career banking bundles.

Building brand connection — storytelling around values, sustainability, and community impact that aligns with younger Australians’ expectations.

Simplifying engagement — leveraging preference centres, mobile notifications, and tailored campaigns to keep communications relevant and easy to act on.

Rethinking communication channels — combining digital-first touchpoints (social, SMS, app notifications) with authentic human follow-up through chat, video or branch to create a connected, conversational experience.

Using data to anticipate needs — predictive models to identify emerging life events (like job changes, renting, or home-buying) and prompt timely conversations.

Spark helps operationalise these ideas — connecting data, automation, and analytics to make them actionable. From segmentation and predictive insights to customer journeys and campaign automation, we help mutual banks turn strategic intent into measurable engagement and growth.